The business world changes. Thus, success depends on adopting more efficient ways to get things done.

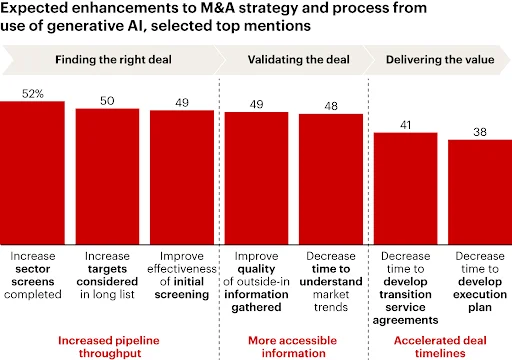

Generative technology has already changed the way we source, analyze, and execute deals. In 2024, 21% of M&A practitioners reported using these tools, up from 16% the year before. Among the most active acquirers, more than a third have already built them into their processes.

Private equity is moving even faster. Over 60% of firms are applying advanced tools to improve sourcing, screening, and diligence. The course is set. Those who integrate these capabilities capture more value and compete more effectively in the deal market.

What you’ll learn in this article:

- What AI means in the context of M&A

- Why it’s becoming essential for deal strategy in 2025

- The main ways AI is applied across the M&A lifecycle

- How generative tools can boost deal performance

- Challenges of adopting AI in M&A

- How to use AI-powered virtual data rooms effectively

- Practices for building an AI-enabled M&A strategy

- What the future holds for AI in mergers and acquisitions

What is AI in M&A?

Artificial intelligence in mergers and acquisitions covers new technologies that analyze deal data. These tools generate insights and guide decision-making.

AI functions include the following:

- Predictive. AI analyzes historical data, detects patterns, and forecasts deal outcomes that help executives assess potential targets and value creation.

- Generative. Tools create draft reports, integration plans, and scenario analyses, reducing manual effort.

- Analytical. AI reviews structured and disorganized data to highlight anomalies and surface insights.

These capabilities help deal teams make smarter decisions and uncover opportunities.

Why AI is becoming essential for M&A strategy in 2025

As teams manage vast amounts of financial, operational, and market data under tight deadlines, deals are becoming increasingly complex. AI is now essential for organizations that want to stay competitive. Several factors are driving its adoption:

- Speed and efficiency. Faster decision-making allows executives to act confidently under tight deadlines.

- Cost management. Reducing manual effort lowers the expenses for executing deals.

- Regulatory and compliance oversight. AI enhances risk monitoring and ensures adherence to financial, legal, and ESG requirements.

- Competitive advantage. Early adopters can move more quickly on opportunities and capture greater deal value.

- ESG and governance. Enhanced monitoring supports sustainability initiatives and meets stakeholder expectations.

These drivers make generative AI technologies a critical enabler for speed and resilience in the deal strategy.

Learn more: Key insights from recent M&A deals

Core applications of AI in the M&A lifecycle

Generative and analytical tools help teams make smarter decisions and reduce resource strain in the following ways:

1. Deal sourcing and target identification

AI sifts through market data, financial statements, and industry trends to spot targets that align with a company’s strategic goals. Predictive models can flag emerging opportunities and highlight companies with the greatest potential for value creation.

2. Valuation and strategy development

Generative and analytical tools let teams model deal scenarios, forecast synergies, and estimate potential returns. AI systems can test multiple transaction structures and give executives the insight they need. It refines strategy and optimizes deal terms.

3. Due diligence and risk management

Gen AI solutions speed up the review of contracts, financials, and operational data. They detect anomalies, surface hidden risks, and uncover potential liabilities. Thus, teams don’t get bogged down in manual data review.

4. Negotiation and legal structuring

Advanced tools support drafting term sheets, analyzing deal clauses, and suggesting negotiation strategies based on past outcomes. Moreover, AI helps ensure regulatory compliance, reducing legal risk.

5. Post-merger integration

AI helps integration planning by modeling workflows, identifying cultural or operational gaps, and prioritizing critical initiatives. It helps teams execute faster, track progress, and measure the impact of integration activities on overall deal value.

6. ESG and compliance monitoring

The tools track environmental, social, and governance metrics across acquired entities. Specifically, they flag compliance issues, monitor progress toward sustainability goals, and help ensure regulatory obligations are met.

👁️🗨️The AI-driven ESG and sustainability market is projected to reach $846.75 billion by 2032. These statistics highlight the importance of AI in overseeing sustainable business practices.

This is how generative and analytical tools unlock value that traditional processes might miss.

Generative AI in M&A: You’re Not Behind—Yet | Bain & Company

Benefits of AI in M&A strategy

Incorporating AI into mergers and acquisitions delivers measurable advantages across dealmaking, the due diligence processes, and post-merger activities. Beyond speed and efficiency, its impact spans decision quality, risk management, and value creation:

| Benefit | How AI works | Impact | Example |

|---|---|---|---|

| Faster execution and lower costs | Automates repetitive tasks and accelerates information processing |

| Faster deal cycles allow acquirers to pursue more transactions in a year without increasing headcount |

| Deeper risk detection | Scans large, unstructured datasets to uncover anomalies and patterns humans may miss |

| Early warning on risks helps leadership walk away from value-eroding deals before investing further resources |

| Better competitive insights | Continuously monitors external market, competitor, and sector data |

| Firms using real-time insights can outbid rivals with greater certainty, or avoid auctions where valuations are inflated |

| Improved cultural alignment | Performs communication flow, organizational structure, and sentiment analysis |

| Addressing cultural gaps early helps prevent post-merger attrition, which often erodes projected synergies |

| Enhanced ESG compliance | Integrates ESG data sources and benchmarks into monitoring dashboards |

| Consistent ESG tracking strengthens credibility with regulators and investors, making future capital raising easier |

Learn more: AI in due diligence as a strategic driver

While the benefits are compelling, adopting advanced technologies in dealmaking is not without hurdles. Executives need to balance the promise of faster, smarter decisions with the realities of implementation.

Challenges and risks of AI adoption in M&A

Despite the benefits, organizations must recognize that advanced technology brings a set of vulnerabilities. Understanding these challenges can help you manage expectations and build safeguards into the deal process:

1. Data privacy and security

M&A involves sensitive financial, legal, and employee information. Introducing AI tools creates additional entry points for cyber threats and raises questions about where and how data is stored. Thus, confidentiality protection requires strict governance, secure infrastructure, and clear vendor accountability.

2. Bias in algorithms

AI models can pick up unfair tendencies from the data they learn from. In dealmaking, this may lead to skewed risk assessments, overlooked opportunities, or inaccurate valuations. So, executives must ensure that models are tested and audited for fairness and reliability.

3. AI hallucinations

Generative tools can surface insights that appear credible but are incomplete or misleading. In diligence or valuation, this risk may cause teams to misinterpret exposure or overstate synergies. Therefore, human expertise remains essential to validate outputs before they guide major decisions.

4. Accountability gap

AI accelerates analysis. However, it cannot replace judgment. Successful adoption means combining automation with experienced deal professionals who can challenge assumptions, contextualize insights, and make final calls.

5. Regulatory uncertainty

AI in mergers and acquisitions is a new frontier. So, regulators are beginning to examine its impact on fairness, competition, and privacy. Therefore, companies must prepare for evolving rules that could affect how data is processed and how these tools are deployed in cross-border transactions.

For M&A leaders, success depends on balancing innovation with caution. So, treat AI as a powerful tool but not a replacement for professional expertise and sound governance.

AI-powered virtual data rooms: The future of M&A diligence

Virtual data rooms (VDRs) have long been the backbone of deal execution. Now, their role is shifting as AI capabilities are built into the platforms. Instead of serving as passive repositories, next-generation M&A data room acts as intelligent assistants that accelerate diligence, reduce oversight risk, and enhance collaboration.

Here are the key VDR features and how they benefit buyers and sellers:

1. Auto-classification

AI-powered data rooms categorize documents into specific areas, including contracts, financial statements, HR files, and regulatory materials. It reduces manual sorting, ensures consistency, and accelerates the preparation of large datasets.

- Buy-side benefit. Buyers quickly locate critical documents to accelerate diligence and risk assessment.

- Sell-side benefit. Sellers ensure materials are orderly and complete, reducing errors that could create doubts for buyers.

2. Intelligent search

AI data room software solutions allow contextual and natural-language queries across all documents. Thus, users can ask targeted questions and instantly retrieve relevant passages.

- Buy-side benefit. Buyers improve efficiency by surfacing key clauses, terms, or data points for faster and more accurate analysis.

- Sell-side benefit. Sellers enable quick responses to buyer questions, which demonstrates transparency and preparedness.

3. Anomaly detection

The software uses algorithms to identify irregularities or inconsistencies in contracts, financial data, and user activity. This way, it highlights potential risks that could otherwise go unnoticed.

- Buy-side benefit. Buyers detect hidden liabilities, unusual terms, or operational red flags to reduce deal risk.

- Sell-side benefit. Sellers find inconsistencies and errors before buyers do, protecting deal value and credibility.

4. Predictive analytics for leakage prevention

VDRs monitor user behavior and data access to predict and prevent unauthorized sharing of sensitive information. It helps maintain control over confidential deal documentation.

- Buy-side benefit. Buyers ensure sensitive data accessed by multiple teams stays secure, reducing exposure to leaks.

- Sell-side benefit. Sellers protect proprietary information so that only authorized parties can see approved materials.

5. AI dashboards for investors and advisors

The solution provides real-time visual summaries of diligence progress, risk flags, and priority issues. Moreover, users can customize dashboards for different stakeholders to track activity, diligence findings, and deal status.

- Buy-side benefit. Buyers can consolidate diligence insights in one view, helping leadership make faster, more informed go/no-go decisions.

- Sell-side benefit. Sellers offer visibility into buyer engagement, question patterns, and priority areas, enabling proactive management of the sales process.

Learn more: Buy-side vs sell-side M&A: Difference explained

How to choose the right solution that will boost your efficiency, end-to-end security, and results? Check the best platforms now.

The best AI-powered VDR providers

The following table highlights only the key features of each platform. For a more comprehensive view, we recommend visiting the official websites of each provider and reading user reviews to understand how these solutions perform in specific industries and deal scenarios.

| AI Data Room | Features | Free Trial |

|---|---|---|

| Ideals Visit Website → |

| 30 days |

| Ansarada |

| ✖️ |

| Datasite |

| ✖️ |

| Intralinks |

| ✖️ |

| Imprima |

| 1 month |

These platforms give professionals the speed, confidence, and precision needed to close deals in a high-pressure environment.

Best practices for building an AI-enabled M&A strategy

The firms that succeed focus on clear priorities, simple wins, and the right guardrails. Here are practical steps you can use to approach it:

1. Start small and targeted

- Track concrete improvements such as time saved, errors caught, or risks flagged

- Limit the pilot to a single deal team or type of transaction before scaling to the full organization

- Set measurable goals for the pilot, e.g., “cut document review time by 30%”, to check value

2. Help teams understand the tools

- Train dealmakers, lawyers, and compliance staff on how to read and question AI outputs

- Encourage “human-in-the-loop” review to validate AI findings and add context

- Provide examples of good and bad AI outputs to show common pitfalls

- Offer short reference guides or cheat sheets for quick decision support during deals

3. Set rules for accountability

- Keep records of AI usage, decisions made, and overrides for audit purposes

- Define escalation paths if AI-generated insights conflict with human judgment

- Review outputs regularly to identify patterns where AI may need adjustment

4. Stay aligned with regulations

- Map each AI use case against relevant data privacy, financial disclosure, and ESG obligations

- Schedule regular checks for accuracy, bias, and security of AI tools

- Document compliance efforts so regulators or auditors can follow your process

- Monitor regulatory updates to ensure AI practices continue to meet new requirements

5. Pick reliable partners

- Choose AI-powered data room solutions with a proven track record in your sector

- Request demos and trial runs to see how AI performs in real-world scenarios

- Check references from companies that handle similar deal sizes or industries

- Evaluate vendor support for updates, training, and troubleshooting during critical deal phases

Keep improving

- Treat each deal as a learning opportunity: gather feedback on AI performance and usability

- Adjust training, workflows, and rules based on lessons learned

- Expand successful use cases gradually rather than rushing full-scale adoption

- Document improvements to create a repeatable process for future deals

Handled this way, AI becomes part of a disciplined approach that helps deals run smoother, reduces errors, and strengthens decision-making.

The future of AI in M&A

The innovation pace in the AI sector is accelerating. Furthermore, its impact on mergers and acquisitions is becoming increasingly significant.

As Alex Singla, senior partner and co-leader of QuantumBlack, AI by McKinsey, observes:

“The pace of AI innovation is accelerating, with breakthroughs in generative and autonomous systems rapidly expanding what’s possible across industries. Today, the true differentiator is not just technical capability; it is the ability to rewire operating models, talent, and governance, embedding AI deeply into workflows to deliver measurable business impact. Organizations that move decisively from experimentation to scaled adoption, while building robust guardrails for trust and accountability, will be best positioned to capture AI’s transformative potential.”

For M&A professionals, this signals that AI will do more than speed up document review and routine tasks. In the next five years, companies that thoughtfully integrate AI into deal sourcing, valuation, risk assessment, and post-merger planning will be in a stronger position to make informed decisions, move efficiently, and create lasting value. The focus is on adopting AI in ways that improve outcomes and support sound judgment.

As highlighted by EY:

“A close collaboration between AI software and experienced humans will be vital to offer top-notch M&A due diligence services in the future.”

This point underscores the importance of leveraging AI-powered virtual data rooms. They enhance efficiency and insight but are most effective when paired with skilled deal professionals who can interpret results, make judgments, and guide critical decisions.

Key takeaways

- Generative technology is reshaping M&A. Early adopters are executing deals faster, identifying value more accurately, and improving integration outcomes.

- AI enhances every stage of the deal lifecycle. From deal sourcing and valuation to diligence, negotiation, integration, and ESG compliance, AI improves efficiency, reduces risk, and provides actionable insights.

- Virtual data rooms are central to success. AI-powered VDRs automate redactions, provide intelligent search, track sensitive data, and support secure collaboration, while experienced deal teams interpret and act on the data-driven insights.

- Challenges and best practices matter. Effective adoption requires careful governance, human oversight, regulatory alignment, and targeted training to maximize benefits and address risks.